By John Jordan

How to Create an SAP Internal Order Budget

An internal order budget, or approved funds, is maintained at an overall or annual level.

You activate availability control to issue warning or error messages based on defined tolerances. Let's examine the internal order budget and availability control.

You maintain a budget profile with Transaction OKOB or via the IMG menu path:

Controlling - Internal Orders - Budgeting and Availability Control

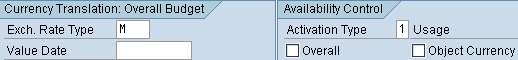

Double-click a budget profile to display the screen shown in Figure 1.

Figure 1: Internal Order Budget Profile

Activation Type 1 indicates Automatic activation of Availability Control during budget allocation.

If the Overall checkbox is selected, availability control checks against the overall budget. If it isn't selected, availability control checks against the annual budget.

Availability control works with controlling the area currency, unless you select the Object Currency checkbox. You can assign the budget profile to an internal order type with Transaction KOAB or via the first menu path.

You maintain availability control tolerances via the following IMG menu path:

Controlling - Internal Orders - Budgeting and Availability Control - Define Tolerance Limits for Availability Control

Left-click, then right-click in an action field, select possible entries to display the screen shown in Figure 2.

Figure 2: Availability Control Tolerance Limits

The action Act. field defines the messages and emails the system will send at specific degrees of budget overrun. In this example, when the budget is nearly consumed at 95%, a warning is issued with an automatic email to the persons responsible. Please specify a budget manager with Transaction OK14, or the system will issue an error message. With a budget overrun of 105%, an error message is issued.

You enter an order budget with Transaction KO22 or via the menu path:

Accounting - Controlling - Internal Orders - Budgeting - Original Budget

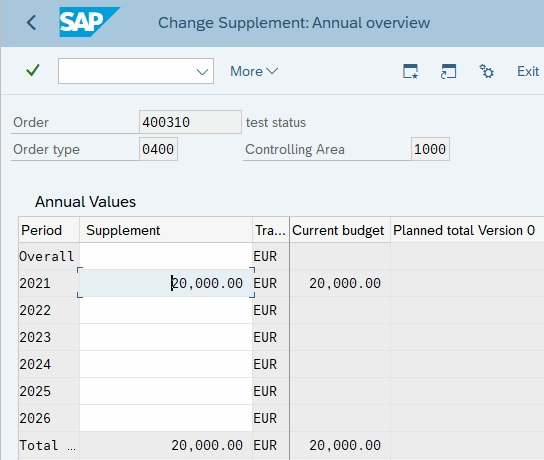

You can enter a budget as shown in the example shown in Figure 3.

Figure 3: Change Original Budget Annual Overview

The overall budget can be greater than the sum of the annual budgets, but cannot be smaller. The assigned amount of 95,000.00 is due to a manual journal entry and appears in an annual Budget row because the Overall checkbox in the budget profile in Figure 1 is not selected.

Figure 4 shows the original Planned Total Version 0 amount of 100,000.00. The current budget of 120,000.00 is greater because a budget supplement of 20,000.00 was posted with Transaction KO24 as shown in Figure 4.

Figure 4 Internal Order Budget Supplement

You've been reading Tip #14

More: 100 Things You Should Know About Controlling with SAP

What readers are saying about this book:

- Great SAP shortcuts, and it's fun to read

- John's book has paid for itself many times over

- My colleagues appreciate me sharing these ideas

- The Material Ledger conversion and go-live ideas saved me so much time

Glossary

Activity Input Planning

As cost centers provide planned output services based on activity quantities with Transaction KP26, you can plan cost center activity input quantities from other cost centers with activity input planning using Transaction KP06.

Activity Type

An activity type identifies activities provided by a cost center to manufacturing

orders. The secondary type general ledger account associated with an activity type identifies the activity costs on the cost center and detailed reports.

Actual Costing

Actual costing determines what portion of the variance is debited to the next-highest level using material consumption. All purchasing and manufacturing difference postings are allocated upward through the BOM to assemblies and finished goods. Variances can be rolled up over multiple production levels and company codes to the finished product.

Actual Costs

Actual costs debit a product cost collector or manufacturing order during business transactions, such as general ledger account postings, inventory goods movements, internal activity allocations, and overhead calculations.

Allocation Structure

An allocation structure allocates the costs incurred for a sender by cost element or cost element group, and it is used for settlement and assessment. An assignment maps a source cost element group to a settlement general ledger account.

Alternative Bill of Materials

Multiple methods of assembly manufacturing and many possible bills of materials (BOMs) can exist. The alternative BOM allows you to identify one BOM in a BOM group.

Availability control

Availability control enables you to control costs actively by issuing warnings and error messages when costs are incurred.

Controlling Area Currency

You use the controlling area currency for cost accounting. You specify the controlling area currency when defining it in customizing for Controlling. You can assign multiple company codes with different currencies to a controlling area.

Cost Center

A cost center is master data that identifies where the cost occurred. At the end of the period, a person responsible for the cost center analyzes and explains cost center variances.

Cost Component

A cost component identifies costs of similar types, such as material, labor, and overhead, by grouping cost elements together in the cost component structure.

Cost Component Group

Cost component groups allow you to display cost components in standard reports. In the simplest implementation, you create a cost component group for each component and assign each group to a corresponding cost component. You assign cost component groups as columns in cost estimate list reports and costed multilevel BOMs.

Cost Component Split

The cost component split is the combination of cost components that make up the total cost of a material. For example, if you need to view three cost components (material, labor, and overhead) for your reporting requirements, combining these three cost components represents the cost component split.

Cost Component Structure

You define which cost components comprise a cost component split by assigning them to a cost component structure. You assign cost elements and origin groups to cost components within the cost component structure.

Cost Component View

Each cost component is assigned to a cost component view. When you display a cost estimate, you can choose a cost component view, which filters the cost components displayed in the cost estimate.

Cost Element

Cost elements are included as part of a general ledger account. Primary cost elements identify external costs, while secondary cost elements identify costs allocated within controlling, such as activity allocations from cost centers to manufacturing orders.

Cost Estimate

A cost estimate calculates the plan cost to manufacture a product or purchase a component. It determines material costs by multiplying BOM quantities by the standard price, labor costs by multiplying operation standard quantities by plan activity price, and overhead by costing sheet configuration.

Costed Multilevel BOM

A costed multilevel BOM is a hierarchical overview of the values of all items of a costed material according to the material's costed quantity structure (BOM and routing). You display a costed multilevel BOM on the left side of a cost estimate screen. You can also view a costed multilevel BOM separately with Transaction CK86_99.

Costing BOM

Costing BOMs are assigned a BOM usage of costing and are usually copied from BOMs with a production usage. You can adjust costing BOMs to differ from production BOMs if necessary. With system-supplied settings, standard cost estimates search for costing BOMs before production BOMs.

Costing Lot Size

The costing lot size should be set as close as possible to actual purchase or production quantities to reduce lot size variance. Unfavorable variances may result if you create a production order for less than the costing lot size. You need setup time to prepare equipment and machinery for assemblies, and that preparation is generally the same regardless of the quantity produced. Setup time spread over a smaller production quantity increases the unit cost. This also applies to externally procured items because vendors typically quote higher unit prices for smaller quantities.

Costing Run

A costing run is a collective processing of cost estimates, which you maintain with Transaction CK40N.

Costing Sheet

A costing sheet summarizes the rules for allocating overhead from cost centers for cost estimates, product cost collectors, and manufacturing orders. The components of a costing sheet include the calculation base (group of cost elements), the overhead rate (percentage rate applied to the base), and the credit key (cost center receiving credit).

Costing Type

The costing type determines if the cost estimate can update the standard price.

Costing Variant

The costing variant contains information on how a cost estimate calculates the standard price. For example, it determines whether the purchasing info record price is used for purchased materials or an estimated price is manually entered in the Planned price 1 field of the Costing 2 view.

Currency Type

The currency type identifies the role of the currency, such as local or global.

Demand Management

Demand management involves planning requirement quantities and dates for assemblies and defining the strategy for planning and producing/procuring a finished product.

Dependent Requirements

Dependent requirements are caused by higher-level dependent and independent requirements when running MRP. Independent requirements, created by sales orders or manually planned independent requirement entries in demand management, determine lower-level dependent material requirements.

Detailed Reports

Detailed reports display cost element details of manufacturing orders and product cost collectors. During variance analysis, you can drill down on cost elements to display line-item reports.

Distribution Rule

You maintain distribution rules in settlement rules, in manufacturing orders, and in product cost collectors.

Event-Based Processing

As of SAP S/4HANA release 2022, event-based processing is available. Goods movements and confirmations represent events that trigger the calculation of overhead according to the costing sheet. Depending on the order's status, this triggers either the posting of a journal entry for the work in process (WIP) or the cancellation of any existing WIP and the calculation of production variances.

External Processing

An external vendor performs external processing of a manufacturing order operation. This is distinct from subcontracting, which involves sending material parts to an external vendor, who manufactures the complete assembly via a purchase order.

Goods Issue

A goods issue is the movement (removal) of goods or materials from inventory to manufacturing or a customer. When goods are issued, the stock in the warehouse is reduced.

GR/IR

GR/IR is the SAP process for executing the three-way match—purchase order, Material Receipt, and vendor invoice. You use a clearing account to record the offset of the Goods Receipt (GR) and Invoice Receipt (IR) postings. The postings are added to the cleaning account balance as soon as they are completely processed.

Internal Order

An internal order monitors an organization's costs and revenue for short—to medium-term jobs. You can carry out planning at a cost element and detailed level, as well as budgeting at an overall level with availability control.

Long-Term Planning

Long-term planning allows you to enter medium- to longer-term production plans, and simulate future production requirements with long-term MRP. You can determine future purchasing requirements for vendor RFQs, update purchasing info records, and transfer planned activity requirements to cost center accounting.

Margin Analysis

Margin Analysis is the refined version of Account-based COPA. The Universal Journal combines financial and managerial accounting and directly records all dimensions, including custom fields. Margin Analysis provides consistent financial information without any reconciliation needs and a financial audit trail. All innovations developed for the Universal Journal are immediately available within Margin Analysis. A consistent approach ensures common usage of ledgers, currencies, valuations, predictions, and simulations and their availability in planning and reporting.

Master Data

Master data is information that stays relatively constant over long periods of time. For example, purchasing info records contain vendor information such as a business name, which usually doesn't change.

Material Master

A material master contains all the information required to manage a material. Information is stored in views, each corresponding to a department or area of business responsibility. They conveniently group information for users in different departments, such as sales and purchasing.

Process Order

A process order is a manufacturing order used in process industries. A master recipe and materials list are copied from the master data to the order. A process order contains operations divided into phases. A phase is a self-contained work step that defines the detail of one part of the production process using a primary resource.

In process manufacturing, only phases are costed, not operations. A phase is assigned to a subordinate operation and contains standard activity values used to determine dates, capacity requirements, and costs.

Internal Order

An internal order monitors an organization's costs and revenue for short—to medium-term jobs. You can plan at a cost element and detailed level and budget at an overall or annual level or with availability control.

Object Currency

Each object in Controlling, such as a cost center or internal order, may use a separate currency specified in its master data. When you create an object in CO, the default object currency is the currency of the company code to which the object is assigned. You can specify a different object currency only if the controlling area currency is the same as the company code currency. There is an object currency for the sender and an object currency for the receiver.

Process Order

A process order is a manufacturing order used in process industries. A master recipe and materials list are copied from the master data to the order. A process order contains operations divided into phases. A phase is a self-contained work step that defines the detail of one part of the production process using a primary resource.

In process manufacturing, only phases are costed, not operations. A phase is assigned to a subordinate operation and contains standard activity values used to determine dates, capacity requirements, and costs.

Procurement Alternative

A procurement alternative represents one of several different ways of procuring a material. You can control the level of detail in which the procurement alternatives are represented through the controlling level. Depending on the processing category, there are single-level and multilevel procurement alternatives. For example, a purchase order is single-level procurement, while production is multilevel.

Production Order

For discrete manufacturing, a production order is used. A BOM and routing are copied from the master data to the order. The routing supplies a sequence of operations describing how to carry out work steps.

An operation can refer to a work center where it is to be performed. It contains planned activities required to carry out the operation. Costs are based on the material components and activity price multiplied by a standard value.

Product Drilldown Reports

Product drilldown reports allow you to slice and dice data based on characteristics such as product group, material, plant, cost component, and period. Product drilldown reports are based on predefined summarization levels and are relatively simple to set up and run.

Production Variance

Production variance is a variance calculation based on the difference between net actual costs debited to the order and target costs based on the preliminary cost estimate and quantity delivered to inventory. You calculate production variance with the target cost version 1. Production variances are for information only and are not relevant for settlement.

Production Version

A production version determines which alternative BOM is used and which task list/master recipe to produce a material or create a master production schedule. You can have several production versions for one material for various validity periods and lot-size ranges.

Purchase Price Variance

When raw materials are valued at the standard price, a purchase price variance will post during goods receipt if the goods receipt or invoice price differs from the material standard price.

Profitability Analysis

Costing-based profitability analysis enables you to evaluate market segments, which can be classified according to products, customers, orders (or any combination), or strategic business units, such as sales organizations or business areas concerning your company's profit or contribution margin.

Profit Center

SAP Profit Center is a management-oriented organizational unit used for internal controlling purposes. Segmenting a company into profit centers allows us to analyze and delegate responsibility to decentralized units.

Purchasing Info Record

A purchasing information record stores all the information relevant to procuring a material from a vendor. It contains the Purchase Price field, which the standard cost estimate searches for when determining the purchase price.

Raw Materials

Raw materials are always procured externally and then processed. A material master record of this type contains purchasing data but not sales.

Routing

A routing is a list of tasks containing standard activity times required to perform operations to build an assembly. Routings and planned activity prices provide cost estimates with the information necessary to calculate product labor and activity costs.

Sales and Operations Planning

Sales and operations planning (SOP) allows you to enter a sales plan, convert it to a production plan, and transfer the plan to long-term planning.

S&OP is slowly being replaced by SAP Integrated Business Planning for Supply Chain (SAP IBP), which supports all S&OP features. S&OP is intended as a bridge or interim solution that allows a smooth transition from SAP ERP to on-premise SAP S/4HANA and SAP IBP. See SAP Note 2268064 for details.

SAP Fiori

SAP Fiori is a web-based interface that can replace the SAP GUI. SAP Fiori apps access the Universal Journal directly, taking advantage of additional fields like the work center and operation for improved variance reporting.

Settlement

Work in process (WIP) and variances are transferred to Financial Accounting, Profit Center Accounting (PCA), and Profitability Analysis (CO-PA) during settlement. Variance categories can also be transferred to value fields in CO-PA.

Settlement Profile

A settlement profile, contained in the order type, contains the parameters necessary to create a settlement rule for manufacturing orders and product cost collectors.

Settlement Rule

A settlement rule determines which portions of a sender's costs are allocated to which receivers. A manufacturing order or product cost collector header data contains a settlement rule.

Setup Time

You need setup time to prepare equipment and machinery for the production of assemblies, and that preparation is generally the same regardless of the quantity produced. Setup time spread over a smaller production quantity increases the unit cost.

Simultaneous Costing

The process of recording actual costs for cost objects, such as manufacturing orders and product cost collectors in cost object controlling, is called simultaneous costing. Costs typically include goods issues, receipts to and from an order, activity confirmations, and external service costs.

Source Cost Element

Source cost elements identify costs that debit objects, such as manufacturing orders and product cost collectors.

Source List

A source list is a list of available sources of supply for a material, which indicates the periods during which procurement is possible. Usually, a source list is a list of quotations for a material from different vendors.

You can specify a preferred vendor by selecting a fixed source of supply indicator. If you do not select this indicator for any source, a cost estimate will choose the lowest cost source as the cost of the component. You can also indicate which sources are relevant to MRP.

Standard Price

The standard price in the Costing 2 view determines the inventory valuation price when price control is set at standard (S). The standard price is updated when a standard cost estimate is released. You normally value manufactured goods at the standard price.

Subcontracting

You supply component parts to an external vendor who manufactures the complete assembly. The vendor has previously supplied a quotation, which is entered in a purchasing info record with a category of subcontracting.

Tracing Factor

Tracing factors determine the cost portions received by each receiver from senders during periodic allocations, such as assessments and distributions.

Universal Journal

The efficiency and speed of the SAP HANA in-memory database allowed the introduction of the Universal Journal single line-item tables ACDOCA (actual) and ACDOCP (plan). The Universal Journal allows all postings from the previous financial and controlling components to be combined in single items. The many benefits include the development of real-time accounting. In this book, we discuss both period-end and event-based processing.

Valuation Class

The valuation class in the Costing 2 view determines which general ledger accounts are updated due to inventory movement or settlement.

Valuation Date

The valuation date determines which material and activity prices are selected when you create a cost estimate. Purchasing info records can contain different vendor-quoted prices for different dates. Different plan activity rates can be entered per fiscal period.

Valuation Grouping Code

The valuation grouping code allows you to assign the same general ledger account assignments across several plants with Transaction OMWD to minimize your work.

The grouping code can represent one or a group of plants.

Valuation Type

You use valuation types in the split valuation process, which enables the same material in a plant to have different valuations based on criteria such as batch. You assign valuation types to each valuation category, which specify the individual characteristics of that valuation category. For example, you can valuate stocks of a material produced in-house separately from stocks of the same material purchased externally from vendors. You then select procurement type as the valuation category and internal and external as the valuation types.

Valuation Variant

The valuation variant is a costing variant component that allows different search strategies for materials, activity types, subcontracting, and external processing. For example, the search strategy for purchased and raw materials typically searches first for a price from the purchasing info record.

Valuation Variant for Scrap and WIP

This valuation variant allows a choice of cost estimates to valuate scrap and WIP in a WIP at target scenario. If the routing structure is changed after a costing run, WIP can still be valued with the valuation variant for scrap and WIP, resulting in a more accurate WIP valuation.

Valuation View

In the context of multiple valuation and transfer prices, you can define the following views:

- Legal valuation view

- Group valuation view

- Profit center valuation view

Work Center

Operations are carried out at work centers, such as machines, production lines, or employees. Work center master data contains a mandatory cost center field. A work center can only be linked to one cost center, while a cost center can be connected to many work centers.

Work in Process

Work in process (WIP) represents production costs of incomplete assemblies. For balance sheet accounts to accurately reflect company assets at period end, WIP costs are moved temporarily to WIP balance sheet and profit and loss accounts. WIP is canceled during period-end processing following delivery of assemblies to inventory.