- Walk through SAP product costing from end to end

- Initial cost planning, cost estimates, production order costing, reporting, and actual costing

Get your copy now: Product Cost Controlling with SAP

Table of Contents by Chapter

-

Chapter 1 Integrated Planning

-

Chapter 2 Controlling Master Data

-

Chapter 3 Material Master Data

-

Chapter 4 Logistics Master Data

-

Chapter 5 Costing Sheets

-

Chapter 6 Cost Components

-

Chapter 7 Costing Variant Components

-

Chapter 8 Costing Variant Tabs

-

Chapter 9 Standard Cost Estimates

-

Chapter 10 Preliminary Cost Estimates

-

Chapter 11 Unit Cost Estimates

-

Chapter 12 Preliminary Costing

-

Chapter 13 Simultaneous Costing

-

Chapter 14 Overhead

-

Chapter 15 Work in Process

-

Chapter 16 Variance Calculation

-

Chapter 17 Settlement

-

Chapter 18 Special Topics

-

Chapter 19 Information System

-

Chapter 20 Trends in Product Cost Controlling

-

Enhancement Packages and Business Function

-

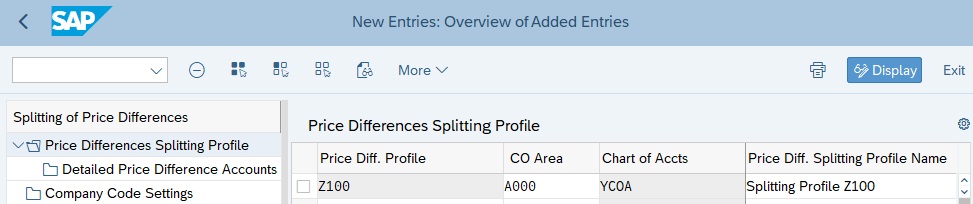

FIN_CO_COGM: Multiple Valuation of Cost of Goods Manufactured

-

LOG_MM_SIT: Cross-Company-Code Stock/Actual Costing

-

LOG_EAM_OLC: Operation Account Assignment

-

FIN_CO_CCMGMT: Cost Center Management

-

GLOSSARY

PART I: Integrated Planning

We first create sales plan quantities in Profitability Analysis CO-PA or sales and operations planning S&OP. We convert these quantities into a production plan that is transferred to demand management. SAP Integrated Business Planning IBP for Supply Chain will gradually replace S&OP.

Long-term planning determines work center loads and purchasing requirements. You transfer activity quantities to Cost Center Accounting CCA, where plan activity prices are determined.

Chapter 1 Integrated Planning

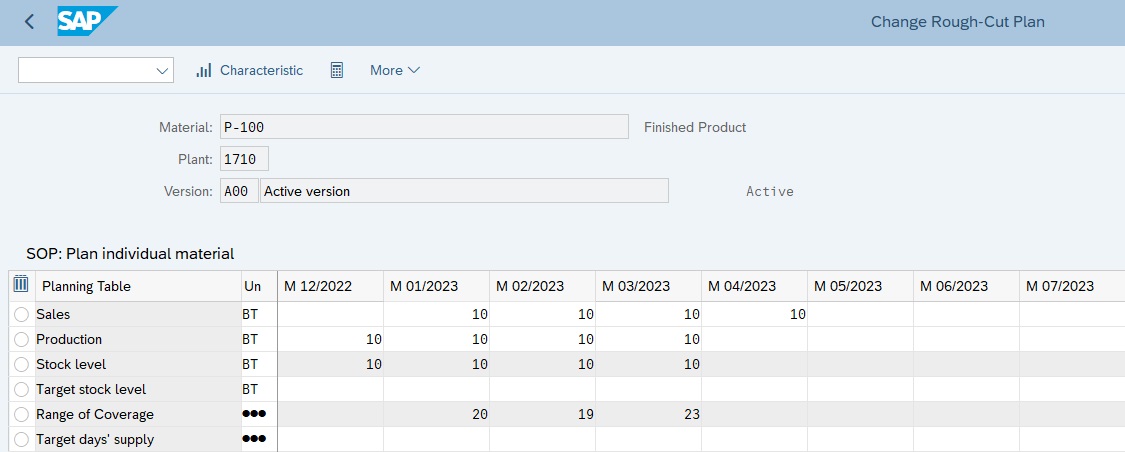

In Figure 1, follow a best-practice planning scenario, including S&OP, & long-term planning runs.

Figure 1 : Sales and Operations Planning

This 3rd edition includes flexible planning and uploading plan data from Excel to CCA.

PART II: Product Cost Planning

You plan procurement and production costs, and set prices for materials and services.

You determine the purchase price for purchased items, and the manufacturing cost for assemblies.

The following master data and configuration chapters cover how to setup and create cost estimates.

Master Data

Master data is information that stays constant over long periods of time. In the following three chapters we examine product cost planning master data fields, while providing many examples and case scenarios. We discuss Controlling, Material Master, and Logistics master data, as follows:

Chapter 2 Controlling Master Data

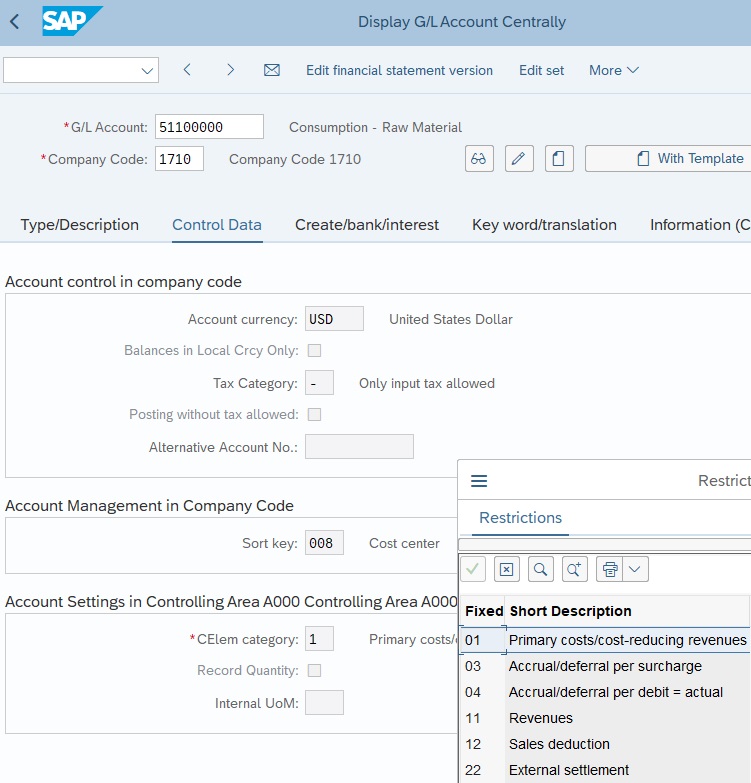

We discuss CO master data, including cost elements, cost centers, activity types, and statistical key figures, as shown in Figure 2.

Figure 2: Maintain GL Accounts Centrally

Learn about COS cost elements, how to swap cost center standard hierarchy, & activity type groups.

Chapter 3 Material Master Data

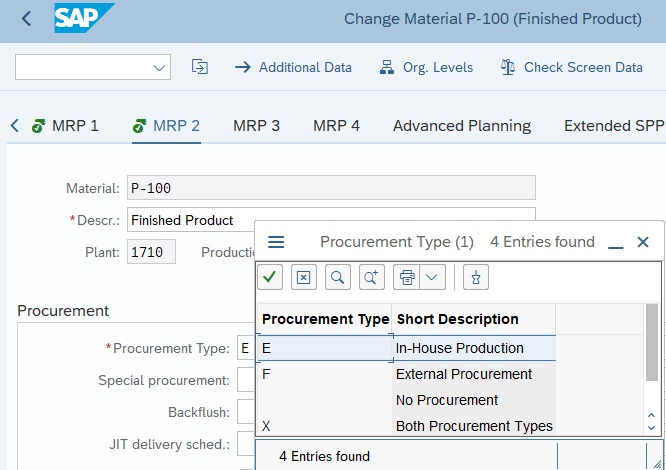

As shown in Figure 3, we examine fields in material master views, including Material Requirements Planning (MRP), Controlling (CO), and Accounting.

Figure 3: Change MRP2 View

We also examine:

- ABC indicator

- Fixed lot size

- Discontinued Materials

- Material Ledger Documents

- Actual cost component split

Chapter 4 Logistics Master Data

We examine logistics master data, including bills of materials (BOMs), routings shown in Figure 4, product cost collectors, and purchasing info records.

Figure 4 Example BOM and Routing

Topics include recursive BOMs, product cost collector lists, plant-specific purchasing info records, & source lists.

Configuration

Most configuration settings are made when you first implement SAP. All configuration settings are closely controlled and monitored because they have a major impact on your company's system process design. We explain the configuration in the following four chapters:

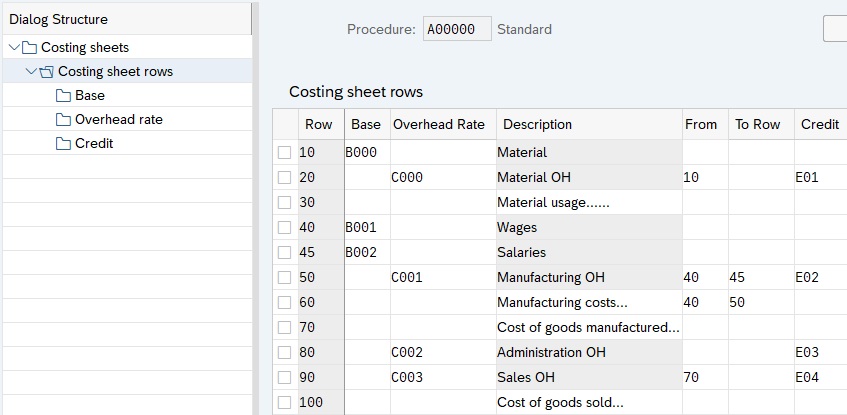

Chapter 5 Costing Sheets

We examine overhead costing sheets for overhead calculation, as shown in Figure 5.

Figure 5 Costing Sheet

This chapter includes:

- Dependency

- Overhead groups and keys

- Default costing sheets

- Quantity-based overhead

Chapter 6 Cost Components

For reporting purposes, we analyze cost components and structures and how they group similar costs, such as material, labor, and overhead, as shown in Figure 6.

Figure 6: Cost Components

We look at how cost component groups improve reporting with cost components in cost estimate lists.

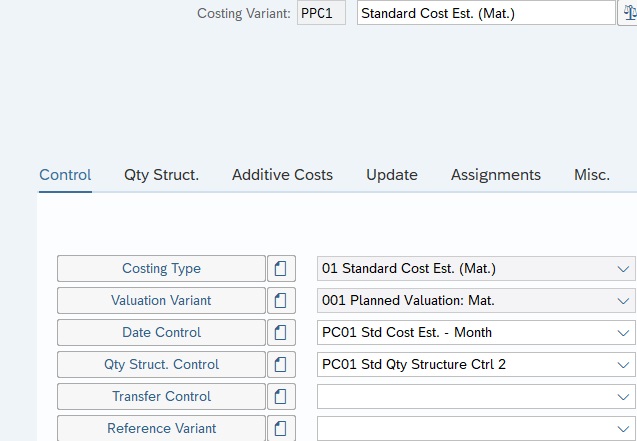

Chapter 7 Costing Variant Components

We examine in detail how you set up costing variant components that contain the configuration required to create cost estimates including:

- Costing Type

- Valuation Variant

- Date Control

- Quantity Structure Control

- Transfer Control

- Reference Variant

You display a costing variant with Transaction OKKN to display the screen shown in Figure 7.

Figure 7 Standard Costing Variant PPC1

The detailed information on delivery costs for purchased materials are included.

Continue Reading: Product Cost Controlling with SAP

Chapter 8 Costing Variant Tabs

We examine how you set up costing variant tabs that contain the configuration required to create cost estimates, including:

- Control

- Quantity Structure

- Additive Costs

- Update

- Assignments

- Miscellaneous

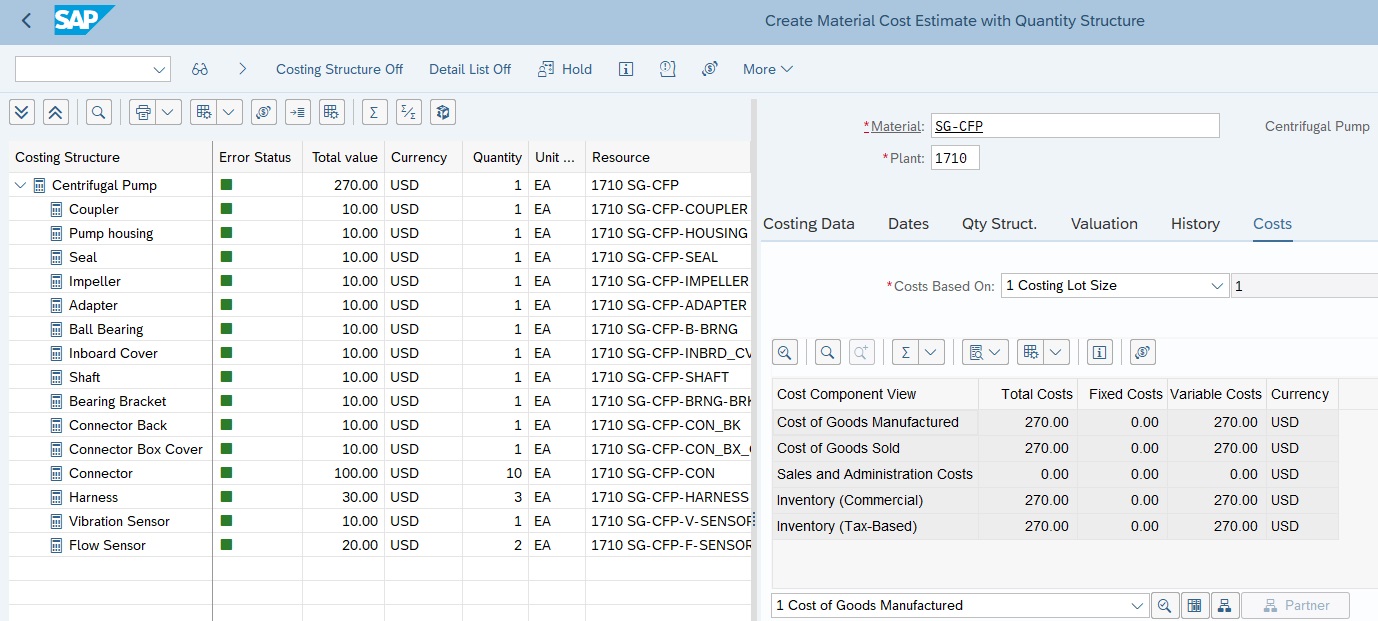

Chapter 9 Standard Cost Estimates

We discuss how to create, mark, and release standard cost estimates to update the standard price and revalue inventory as shown in Figure 9.

Figure 9 Create Standard Cost Estimate

We examine the mark and release process and costing runs, which automate the mass processing of standard cost estimates. We include information on marking allowances and optimizing costing runs.

Chapter 10 Preliminary Cost Estimates

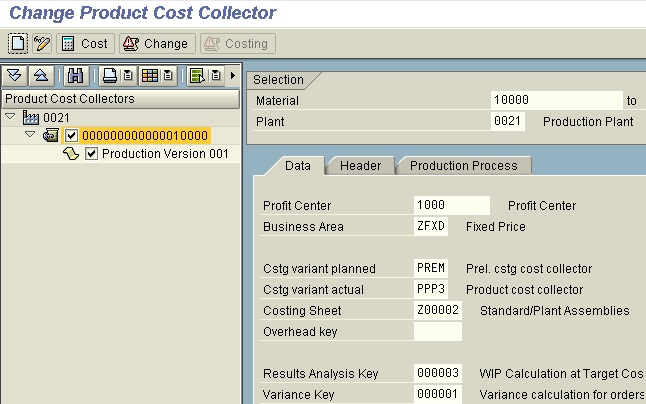

We detail how preliminary cost estimates calculate the planned costs for manufacturing orders and product cost collectors, as shown in Figure 10.

Figure 10: Change Product Cost Collector

Chapter 11 Unit Cost Estimates

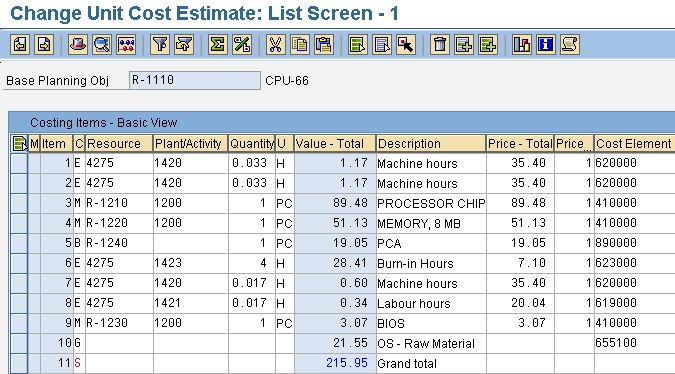

We look at how unit cost estimates are designed for use during the product development phase.

Figure 11 Unit Cost Estimate for Product Development

They are easily changed because they resemble a spreadsheet format, as shown in Figure 11, which is ideal for a development environment.

Join us at SAP Controlling Conference! Meet John Jordan and other SAP expert speakers. CLICK HERE to learn more.

Part III: Cost Object Controlling

Cost Object Controlling allows you to determine planned costs for cost objects, post actual costs, and then analyze variances, as discussed in the following chapters.

Planned and Actual Costs

In these chapters, we determine how to plan and post actual costs to cost objects:

Chapter 12 Preliminary Costing

We analyze how preliminary cost estimates plan costs for cost objects such as manufacturing orders and product cost collectors based on order type configuration, as shown in Figure 12.

Figure 12: Preliminary Cost Estimate

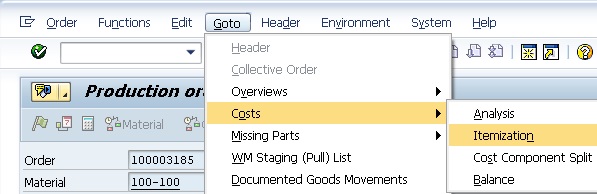

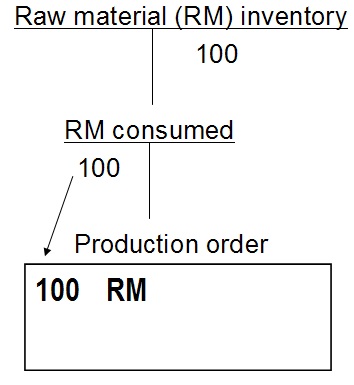

Chapter 13 Simultaneous Costing

We examine how actual costs, such as component and sub-assembly goods issues and activity costs, are posted to cost objects during production order and process order activity confirmations, as illustrated in Figure 13.

Figure 13 Goods Issue to Production Order

We cover default activities and operation sequences, Margin Analysis, & Detailed Reports.

Period-End Processing

During period-end processing, you carry out overhead, work in process, and variance calculation, as well as settlement, as discussed in the following four chapters:

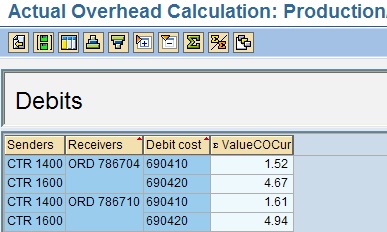

Chapter 14 Overhead

We examine how you perform overhead period-end calculations, as shown in Figure 14, based on the costing sheet configuration discussed in Chapter 5.

Figure 14 Overhead Calculation Results Screen

This third edition includes information on how SAP S/4HANA improves overhead processing.

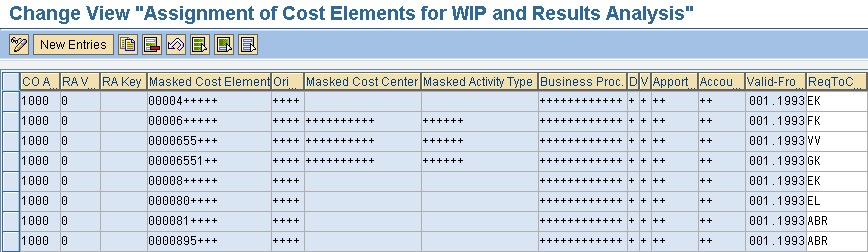

Chapter 15 Work in Process

We look at how work in process (WIP) is configured and how the period-end step is executed, as shown in Figure 15.

Figure 15 : Assign Cost Elements For WIP and Results Analysis

The new 3rd edition includes information on how SAP S/4HANA improves WIP processing.

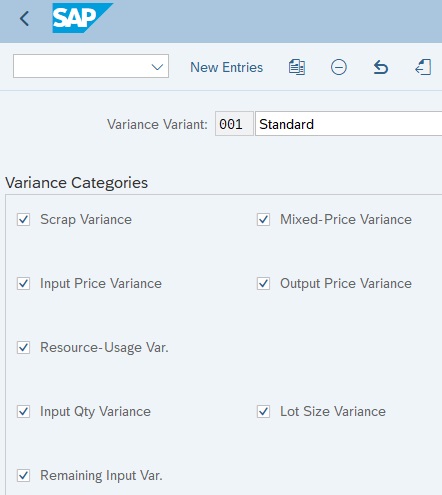

Chapter 16 Variance Calculation

We look at production variance configuration, period-end processing and analysis, and examples of the types of variance calculation as shown in Figure 16.

Figure 16 Variance Calculation Selection Screen

We also discuss how SAP S/4HANA improves variance calculation performance.

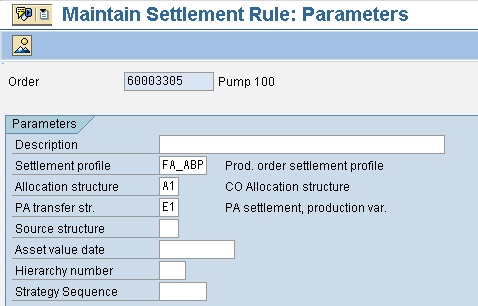

Chapter 17 Settlement

We analyze the settlement configuration and the period-end processing, as shown in Figure 17. We discuss settlement and processing types, including the allocation structure and PA transfer structure.

Figure 17: Settlement Rule Parameters

We examine new transactions available with SAP S/4HANA.

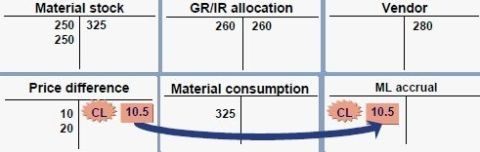

Chapter 18 Special Topics

We discuss configuration and period-end processing for:

- Sales Order Controlling

- Subcontracting

- SAP Material Ledger

Figure 18 SAP Material Ledger Actual Costing Without Revaluation

- Delivery costs

- Overhead Templates

- Mixed cost estimates

- Cost estimate user exits

This third edition includes information on how SAP S/4HANA improves sales order controlling, SAP Material Ledger processing, and reporting.

Continue Reading: Product Cost Controlling with SAP

Part IV: Information System and Trends

We discuss the standard reporting available for Product Cost Controlling.

Chapter 19 Information System

We examine the standard reports available for both Product Cost Planning and Cost Object Controlling and how to drill down from high-level summarization reports to detailed reports based on cost elements and line item reports. We also discuss the production order information system and standard CCA reports, as shown in Figure 19.

Figure 19 Standard Cost Center Report

Includes SAP S/4HANA improvements with order summarization and line item reporting.

Get Your Copy Now: CLICK HERE

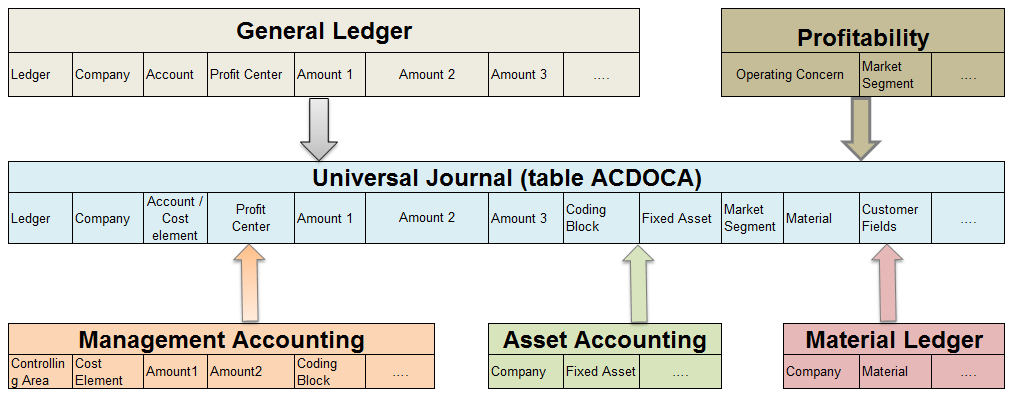

Chapter 20 Trends in Product Cost Controlling

This chapter examines Enhancement Packages (EHPs) and how they deliver your system's latest developments through business functions.

- We examine four business functions closely related to CO.

- We also look at the Universal Journal, as shown in Figure 20.

Figure 20 Universal Journal Table ACDOCA

We examine the benefits and improvements resulting from SAP S/4HANA, including the Universal Journal, the single source of truth, and SAP Fiori apps.

Enhancement Packages and Business Functions

Previously, SAP delivered new functionality through either Support Packages (SPs) or complete software upgrades and new versions. This process required functional teams to write test scripts with expected results and thoroughly test all methods used by the company to ensure none would be adversely affected. Coordination between different departments on the timing of an upgrade can be challenging, as finance departments often have distinct busy periods compared to sales and distribution or materials management. Consequently, many companies deferred the introduction of SPs or upgrades, thereby missing out on the latest functionality and process improvements.

Now that we've discussed EHPs and business functions in general, let's examine four specific business functions related to Product Costing and Controlling.

1. FIN_CO_COGM: Multiple Valuation of Cost of Goods Manufactured

Available since EHP 5, this CO business function supports the valuation of the cost of goods manufactured (COGM) in multiple accounting approaches for depreciation, activity prices, and COGM and inventory values, described as follows:

- Transfer of depreciation from Asset Accounting to Controlling

The depreciation values for international accounting principles are updated to the leading ledger

GLOSSARY

Activity Type

An activity type identifies activities provided by a cost center to manufacturing

orders. The secondary type general ledger account associated with an activity type identifies the activity costs on cost center and detailed reports.

Biil of Material (BOM)

A bill of material is a structured hierarchy of components necessary to build an assembly. BOMs, together with purchasing info records, allow cost estimates to calculate the material costs of assemblies

Cost Center

A cost center is master data that identifies where the cost occurred. At the end of each period, a responsible person assigned to the cost center analyzes and explains the cost center variances.

FBL3N - G/L Account Line Item Display

FBl3N displays G/L line items. It does so only for the G/L accounts that have the 'Display Line Item' checkbox selected.

F.13 - Automatic Clearing

You use Transaction F.13 to post automatic clearing.

F.19 - Analyze GR/IR Account and Accrual

F. 19 analyzes the GR/IR clearing account and posts adjustment entries for outstanding amounts to adjustment accounts. It makes the offsetting entry to the account for goods delivered but not invoiced or to the account for goods invoiced but not delivered.

FS10N - G/L Account Balance Display

This report lets you view the totals of a single or range of G/L accounts. The totals are by month to give you an overview of how the account has changed over a period of time.

You access this report with Transaction FS10N.

Goods Receipt

It is a goods movement used to post goods received from external vendors or in-plant production. All goods receipts increase stock in the warehouse.

GR/IR Account Maintenance

Transaction MR11 helps you correct the balance on the GR/IR, which is caused by a difference in quantity (not price) between the invoice and the goods receipt. It should only be used when no more invoices or goods receipts are expected or can be posted.

Profit Center

A profit center receives postings made in parallel to cost centers and other master data, such as orders. Profit center accounting is integrated with the Universal Journal with S/4HANA. You normally create profit centers based on areas in a company that generate revenue and have a responsible manager assigned.

If profit center accounting is active, you will receive a warning message if you do not specify a profit center, and all unassigned postings are made to a dummy profit center. You activate profit center accounting with configuration Transaction OKKP, which maintains the controlling area.

Purchase Order

The purchase order is a legal contract that binds the supplier to provide the materials or services and the purchaser to pay upon receipt of the materials or services.

Standard Cost Estimate

This is a material cost estimate used to calculate the standard price of a material. The cost estimate must be executed with a costing variant that updates the material master, and the cost estimate must be released. A standard cost estimate can be released only once per period and is typically created for each product at the beginning of a fiscal year or new season.

Standard Price

The standard price in the Costing 2 view determines the inventory valuation price if price control is set at standard (S). The standard price is updated when a standard cost estimate is released. You normally value manufactured goods at the standard price.

Statistical Key Figure

Statistical key figures define values describing cost centers, profit centers, and overhead orders such as the number of employees or minutes of long-distance phone calls. You can use statistical key figures as the tracing factor for periodic transactions such as cost center distribution or assessment. You can post both planned and actual statistical key figures.

Activity Type

An activity type identifies activities provided by a cost center to manufacturing orders. The secondary cost element associated with an activity type identifies the activity costs on cost center and detailed reports

Allocation Structure

An allocation structure allocates the costs incurred by a sender to specific cost elements or cost element groups, and it is used for settlement and assessment purposes. An assignment maps a source cost element group to a settlement general ledger account.

Alternative Hierarchy

While there can only be one cost center standard hierarchy, you can create as many alternative hierarchies as you like. You create an alternative hierarchy by creating cost center groups

Automatic Account Assignment

Automatic account assignment enables you to specify a default cost center for each cost element within a plant using Transaction OKB9.

Availability control

Availability control enables you to actively manage costs by issuing warnings and error messages when costs are incurred.

Bill of Material (BOM)

A bill of material (BOM) is a structured hierarchy of components necessary to build an assembly. BOMs, together with purchasing info records, allow cost estimates to calculate the material costs of assemblies.

Controlling Area Currency

You use the controlling area currency for cost accounting. You specify the controlling area currency when defining the controlling area in customizing for Controlling . You can assign more than one company code with different currencies to a controlling area.

Cost Center

A cost center is master data that identifies where the cost occurred. A responsible person assigned to the cost center analyzes and explains cost center variances at period end.

Cost Component

A cost component identifies costs of similar types, such as material, labor, and overhead costs by grouping together cost elements in the cost component structure.

Cost Component Group

Cost component groups allow you to display cost components in standard reports. In the simplest implementation, you create a cost component group for each cost component and assign each group to a corresponding cost component. You assign cost component groups as columns in cost estimate list reports and costed multilevel BOMs.

Cost Component Split

The cost component split refers to the combination of cost components that comprise the total cost of a material. For example, suppose you need to view three cost components— material, labor, and overhead —for your reporting requirements. In that case, the combination of these three cost components represents the split of these cost components.

Cost Component Structure

You define which cost components make up a cost component split by assigning them to a cost component structure. Within the cost component structure, you assign cost elements and origin groups to cost components.

Cost Component View

Each cost component is assigned to a cost component view. When you display a cost estimate, you can choose a cost component view, which filters the cost components displayed in the cost estimate.

Cost Element

Cost elements are included as part of a general ledger account. Primary cost elements identify external costs, while secondary cost elements identify costs allocated within controlling, such as activity allocations from cost centers to manufacturing orders.

Cost Estimate

A cost estimate calculates the plan cost to manufacture a product or purchase a component. It determines material costs by multiplying BOM quantities by the standard price, labor costs by multiplying operation standard quantities by plan activity price, and overhead by costing sheet configuration.

Costed Multilevel BOM

A costed multilevel BOM is a hierarchical overview of the values of all items of a costed material according to the materials costed quantity structure (BOM and routing). You display a costed multilevel Bill of Materials (BOM) on the left side of the cost estimate screen. You can also view a costed multilevel BOM separately with Transaction CK86_99.

Costing BOM

Costing BOMs are assigned a BOM usage of costing and are usually copied from BOMs with a usage of production. You can make adjustments to costing BOMs if you require them to be different from production BOMs. With system-supplied settings, standard cost estimates search for costing BOMs before production BOMs.

Costing Lot Size

The costing lot size should be set as close as possible to actual purchase or production quantities to reduce lot size variance. Unfavorable variances may result if you create a production order for a quantity that is less than the costing lot size. You need setup time to prepare equipment and machinery for production of assemblies, and that preparation is generally the same regardless of the quantity produced. Setup time spread over a smaller production quantity increases the unit cost. This also applies to externally procured items because vendors typically quote higher unit prices for smaller quantities.

Costing Run

A costing run is a collective processing of cost estimates, which you maintain with Transaction CK40N.

Costing Sheet

A costing sheet summarizes the rules for allocating overhead from cost centers for cost estimates, product cost collectors, and manufacturing orders. The components of a costing sheet include the calculation base (group of cost elements), overhead rate (percentage rate applied to base), and credit key (cost center receiving credit).

Costing Type

The costing type determines if the cost estimate can update the standard price.

Costing Variant

The costing variant contains information on how a cost estimate calculates the standard price. For example, it determines if either the purchasing info record price is used for purchased materials, or an estimated price is manually entered in the Planned price 1 field of the Costing 2 view.

Currency Type

The currency type identifies the role of the currency such as local or global.

Demand Management

Demand management involves planning the quantities and dates of assemblies, as well as defining the strategy for designing and producing or procuring a finished product.

Dependent Requirements

Dependent requirements are caused by higher-level dependent and independent requirements when running MRP. Independent requirements, created by sales orders or manually planned independent requirement entries in demand management, determine lower-level dependent material requirements.

Detailed Reports

Detailed reports display cost element details of manufacturing orders and product cost collectors. During variance analysis, you can drill down on cost elements to display line-item reports.

Distribution Rule

You maintain distribution rules in settlement rules, as well as in manufacturing orders and product cost collectors.

Enhancement Package

A collection of new and improved business functions for SAP Business Suite and SAP ERP. These optional enhancement packages can be configured in a wholly modular fashion by activating only the latest features and functionalities customers want.

Event-Based Processing

As of SAP S/4HANA release 2022, event-based processing is available. Goods movements and confirmations represent events that trigger the calculation of overhead according to the costing sheet. Then, depending on the order's status, this triggers either the posting of a journal entry for the work in process (WIP) or the cancellation of any existing WIP and the calculation of production variances.

External Processing

An external vendor performs external processing of a manufacturing order operation. This is distinct from subcontracting, which involves sending material parts to an external vendor, who manufactures the complete assembly via a purchase order.

Goods Issue

A goods issue is the movement (removal) of goods or materials from inventory to manufacturing or a customer. When goods are issued, the stock in the warehouse is reduced.

GR/IR

GR/IR is the SAP process for executing the three-way match—purchase order, Material Receipt, and vendor invoice. You use a clearing account to record the offset of the Goods Receipt (GR) and Invoice Receipt (IR) postings. As soon as they are completely processed, the postings are added to the cleaning account balance.

Internal Order

An internal order monitors an organization's costs and revenue for short—to medium-term jobs. You can carry out planning at a cost element and detailed level and budgeting at an overall level with availability control.

Long-Term Planning

Long-term planning enables you to develop medium- to long-term production plans and simulate future production requirements using long-term MRP. You can determine future purchasing requirements for vendor RFQs, update purchasing info records, and transfer planned activity requirements to cost center accounting.

Margin Analysis

Margin Analysis is the refined version of Account-based COPA. The Universal Journal combines financial and managerial accounting, directly recording all dimensions, including custom fields. Margin Analysis provides consistent financial information without requiring reconciliation, along with a comprehensive financial audit trail. All innovations developed for the Universal Journal are immediately available within Margin Analysis. A consistent approach ensures the common usage of ledgers, currencies, valuations, predictions, and simulations, as well as their availability in planning and reporting.

Master Data

Master data is information that stays relatively constant over long periods. For example, purchasing information records typically contain vendor information, such as a business name, which remains relatively unchanged.

Material Master

A material master contains all the information required to manage a material. Information is stored in views, each corresponding to a department or area of business responsibility. Views conveniently group information together for users in different departments, for example, sales and purchasing.

Material Requirements Planning (MRP)

MRP ensures material availability by monitoring stock levels and generating planned orders for Purchasing and Production.

Process Order

A process order is a type of manufacturing order used in process industries. A master recipe and materials list are copied from the master data to the order. A process order contains operations that are divided into phases. A phase is a self-contained work step that defines the details of one part of the production process using a primary resource.

In process manufacturing, only phases are costed, not operations. A phase is assigned to a subordinate operation and contains standard values for activities, which are used to determine dates, capacity requirements, and costs.

Procurement Alternative

A procurement alternative represents one of several methods for procuring a material. You can control the level of detail in which the procurement alternatives are represented through the controlling level. Depending on the processing category, there are single-level and multilevel procurement alternatives. For example, a purchase order is a single-level procurement, whereas production involves multilevel procurement.

Production Order

A production order is used for discrete manufacturing. A BOM and routing are copied from master data to the order. A sequence of operations is supplied by the routing, which describes how to carry out work-steps.

An operation can refer to a work center at which it is to be performed. An operation contains planned activities required to carry out the operation. Costs are based on the material components and activity price multiplied by a standard value.

Product Drilldown Reports

Product drilldown reports allow you to slice and dice data based on characteristics such as product group, material, plant, cost component, and period. Product drilldown reports are based on predefined summarization levels and are relatively simple to setup and run.

Production Variance

Production variance is a type of variance calculation based on the difference between net actual costs debited to the order and target costs based on the preliminary cost estimate and quantity delivered to inventory. You calculate production variance with target cost version 1. Production variances are for information only and are not relevant for settlement.

Production Version

A production version determines which alternative Bill of Materials (BOM) is used, along with which task list or master recipe, to produce a material or create a master production schedule. You can have multiple production versions with varying validity periods and lot-size ranges for one material.

Purchase Price Variance

When raw materials are valued at the standard price, a purchase price variance will be posted during goods receipt if the goods receipt or invoice price differs from the material standard price.

Purchasing Info Record

A purchasing information record stores all the information relevant to procuring a material from a vendor. It contains the Purchase Price field, which the standard cost estimate searches for when determining the purchase price.

Profit Center

A profit center receives postings made in parallel to cost centers and other master data, such as orders. Profit Center Accounting (PCA) is a separate ledger that enables reporting from a profit center point of view. You normally create profit centers based on areas in a company that generate revenue and have a responsible manager assigned.

Invoice Receipt

You enter a vendor invoice in SAP with Transaction MIRO or via the menu path

Logistics - Materials Management - Logistic Invoice Verification - Document Entry - Enter Invoice

Material Ledger Drilldown Reporting

You access ML drilldown reporting with Transaction KKML0 via the following menu path:

Controlling - Product Cost Controlling - Actual Costing/Material Ledger - Material Ledger - Information System - Drilldown Reporting - Run Drilldown Report

CKM3N - Material Price Analysis

Transaction CKM3N Material Price analysis report / Price History View report CKM3N/CKM3 is used to analyse the price consumed for a material in a plant along with overhead.

MB5S - List of GR/IR Balances

MB5S displays any difference between GR and IR quantities & their values.

ME23N - Display PO History

You use ME23N to display information about an existing purchase order to see whether the vendor invoice has been received and/or paid.

MR11SHOW - Display/Reverse MR11 document

MR11 documents can be reversed using MR11_SHOW or by clicking on Account Maintenance, which documents the PO history. Be cautious if more than one PO has been corrected in an MR11 document, as it may reverse the entire document.

Profit Center

A profit center receives postings parallel to cost centers and other master data, such as orders. Profit center accounting is integrated into the Universal Journal with S/4HANA. You normally create profit centers based on areas in a company that generate revenue and have a responsible manager assigned.

If profit center accounting is active, you will receive a warning message if you do not specify a profit center, and all unassigned postings are made to a dummy profit center. You activate profit center accounting with configuration Transaction OKKP, which maintains the controlling area.

Purchase Order

A purchase order is a legal contract that binds the supplier to provide the materials or services and the purchaser to pay upon receipt of the materials or services.

Valuation Class

The valuation class in the Costing 2 view determines which general ledger accounts are updated due to inventory movement or settlement.